income tax rates 2022 ireland

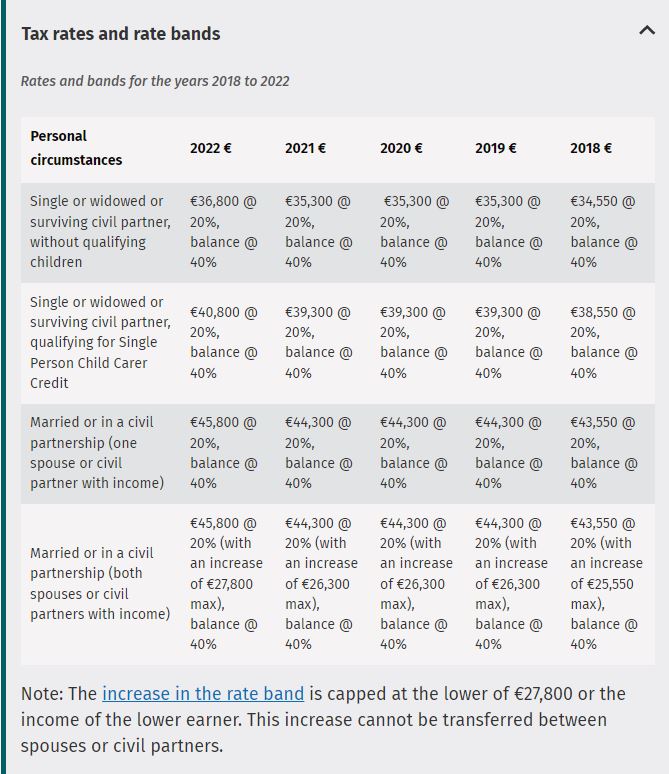

The increase in the rate band is capped at the lower of 27800 or the income of the lower earner. Calculating your Income Tax gives more information on how these work.

Paying Tax In Ireland What You Need To Know

PRSI contribution changed Universal Social Charge changed Income Employer1105 No limit 88 If income is 410 pw or less.

. Wed Mar 23 2022 - 1640 A new middle rate of income tax of 30 per cent is being considered by the Government in order to ease the pressure on middle-income earners amid the cost-of-living crisis. 40 on the. Excise Tobacco Products Tax TPT TPT rates are increased with effect from 13 October 2021.

20 on the first 36800. Value Added Tax VAT Hospitality sector VAT Rate The reduced VAT rate of 9 for the hospitality sector will remain in place until the end of August 2022. An increase in the Personal Tax Credit from 1650 to 1700.

The income values for each tax bracket are shifted slightly depending on your filing status. The Universal tax rates range from 1 7 and the applicable rates depend on the annual income. In 2022 for a single person with an income of 25000 the effective tax rate will be 120 rising to 198 at an income of 40000 and 404 at an income of 120000.

Tax rates range from 20 to 40. First 12012 with a 05 rate Next 7360 with a 2 rate Next 50672 with a 475 rate Social Security Insurance PRSI The rates for Social Security Insurance PRSI are in general 1075 for the employer and in general 4 for the employees. Personal tax credits of 1700 PAYE tax credit of 1650 Income Tax Rate.

The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Calculate your income tax. Local income taxes There are no local income taxes in Ireland.

21294 in a year before deductions o f Income Tax USC and PRSI This is equivalent to 1774 per month. The National Insurance class 1B. 20 on the first 70600.

These limits are increased in respect of dependent children. Married Taxpayers two incomes Personal tax credits of 3400 PAYE tax credit of 1700 Income Tax Rate. Personal Income Tax Income Tax An increase of 1500 in the income tax standard rate band for all earners from 35300 to 36800 for single individuals and from 44300 to 45800 for married couples civil partners with one earner.

Marginal relief may apply where the individuals total income exceeds the specified limit. Or 40950 a week. Budget 2022 1 min read Budget 2022 announced 12 October 2021 features a total budgetary package of 47bn split between expenditure measures worth.

Ireland Income Tax Rates for 2022 Ireland Income Tax Brackets Ireland has a bracketed income tax system with two income tax brackets ranging from a low of 2000 for those earning under 36400 to a high of 4100 for those earning more then 36400 a year. Depending on the profit yield of a site the tax rate applicable can range from 25 to 40. This guide is also available in Welsh Cymraeg.

The total deductions in a year will be 1831 made up of. Use our interactive calculator to help you estimate your tax position for the year ahead. Terms conditions and assumptions.

Summary of USC Rates in 2022 0 12012 05 12012 21295 2 2129501 70044 45 70044 plus 8 Self -employed workers with an income over 100000. Your tax-free Personal Allowance The standard Personal Allowance is. The calculator is designed to be used online with mobile desktop and tablet devices.

Employee class A1 PRSI 4 No limit Universal Social Charge 05 unchanged 0 to 12012 20 unchanged 12013 to 21295 45 unchanged 21296 to 70044 8 unchanged. This allows you to make one annual payment to cover all the tax and National Insurance due on small or irregular taxable expenses or benefits for your employees. EY refers to the global organization and may refer to one or more of the member firms of Ernst Young Global Limited each of which is a separate legal entity.

Someone aged 20 or more earning the Minimum Wage in Ireland in 2022 of 1050 per hour working full time 39 hours a week will earn. Tax rates and credits 2022. Ireland VAT and Sales Tax Rate for 2022 VAT and Sales Tax Rates in Ireland for 2022 Ireland VAT Rate 2100 About 21 tax on a 100 purchase Exact tax amount may vary for different items The current Ireland VAT Value Added Tax is 2100.

Close companies see the Income determination section may be subject to additional corporate taxes on undistributed investment income including Irish dividends and on undistributed income from professional services. For 2022 Tax Year Deductions exist to help lower your taxable income but there is no standard one that exists in every scenario. 40 on the balance.

Personal Tax Credits in Ireland from January 2022 Single Taxpayers. Have a 3 surcharge so they pay 11 USC People with Income under 13000 are exempt from USC. Tue 09 Aug 2022 - 1115 Paul Hosford A new 30 tax rate which would apply to 1m taxpayers will be included in a pre-budget analysis to be.

How does the Ireland Income Tax compare to the rest of the world. -RateAddition for Farmers flat rate is reduced from1 January 2022 56 to 55. Tax rates and rate bands Note.

For 2022 the specified limit is EUR 18000 for an individual who is singlewidowed and EUR 36000 for a married couple. Tax rates bands and reliefs The following tables show the tax rates rate bands and tax reliefs for the tax year 2022 and the previous tax years. EY Ireland Budget Income Tax Calculator Budget 2021.

The current tax year is from 6 April 2022 to 5 April 2023. What will the provisions contained in Budget 2022 mean for you.

How Do Taxes Affect Income Inequality Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Top 8 Countries With No Income Tax That You Should Know

How Do Taxes Affect Income Inequality Tax Policy Center

How To Calculate Income Tax In Excel

Canada Tax Income Taxes In Canada Tax Foundation

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Do Taxes Affect Income Inequality Tax Policy Center

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Much Does A Small Business Pay In Taxes

Canada Tax Income Taxes In Canada Tax Foundation

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

Paying Tax In Ireland What You Need To Know